- Valley Recap

- Posts

- 👷♂️The AI Gold Rush Is Over, The Build Phase Begins💰Bay Area Startups Collectively Secured $2.9B

👷♂️The AI Gold Rush Is Over, The Build Phase Begins💰Bay Area Startups Collectively Secured $2.9B

The Gold Rush is Over. The Industrial Revolution Has Begun.

If 2025 was defined by the frantic race for GPU allocation, a digital "Gold Rush" then 2026 marks the beginning of something far more capital-intensive and physically demanding: the Industrial Revolution of Intelligence.

While headlines debate the existence of an AI bubble, the underlying numbers tell a different story. We are witnessing the start of a $7 trillion infrastructure supercycle, driven not by speculation, but by the hard engineering reality of building the "AI Factories" required to power the next decade of economic growth.

Here is the state of the union for AI infrastructure as we enter 2026.

The $527 Billion Reality Check

The defining metric for 2026 is no longer just chip supply; it is Capital Expenditure (CapEx). Hyperscalers are projected to pour more than $527 billion into infrastructure this year alone.

Skeptics call this a bubble. Operators call it "vendor financing". We are in the deployment phase of a new general-purpose technology, comparable to the build-out of the electrical grid or the railway system. The massive upfront investment is a rational play to lower the cost of producing intelligence to the point where it becomes ubiquitous. The question is no longer if the money will be spent, but who can deploy it effectively before the window closes.

The Shift to "AI Factories"

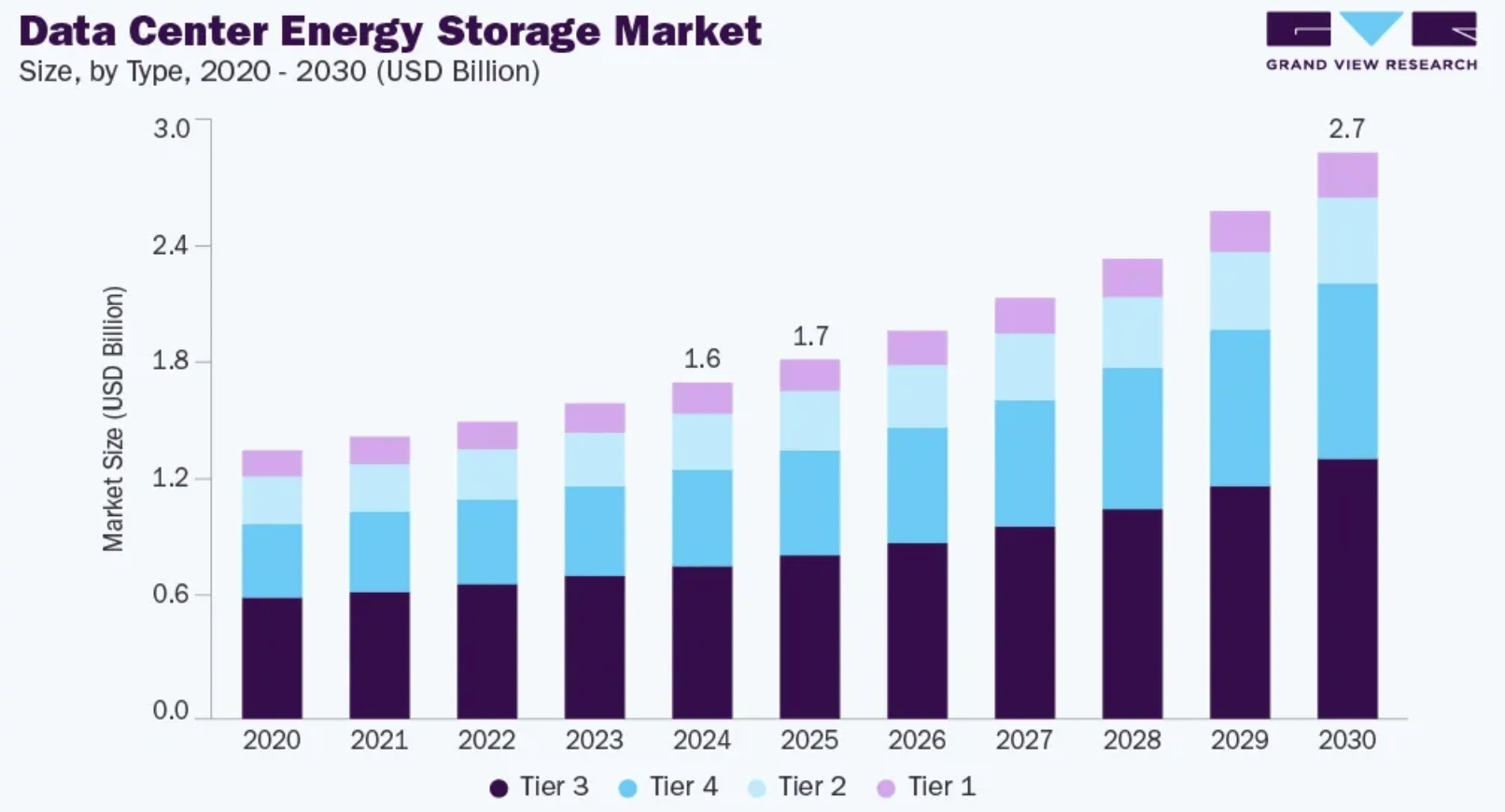

We may need to stop calling them data centers. The facilities being capitalized in 2026 are not designed for passive storage; they are "AI Factories" designed to generate intelligence as a tangible economic output.

This shift changes the physics of the building. We have moved from the cloud era of 10kW racks to the AI era of 45kW to 100kW+ densities. This is a rebuild. The industry is effectively constructing a new physical shell for the internet, optimized for massive parallel compute, liquid cooling, and 1.6T networking fabrics.

The "Inventory" Crisis: Capital is Cheap, Capacity is Scarce

The most critical bottleneck in 2026 is execution. The primary constraint facing the market is no longer demand, but the ability to convert planned capacity into live infrastructure.

We are facing an "inventory crisis." While trillions of dollars are ready to be deployed, there is a structural shortage of finished capacity, power, cooling, and integrated systems. Paper pipelines are meaningless if you cannot plug them in. The "land war" has become a power war, and the winners of this cycle will be those who can solve the physical constraints of the grid and supply chain to deliver usable tokens to the market.

The Mandate to Convene

This transition from allocation to execution requires a new level of collaboration between the builders (infrastructure), the buyers (capital), and the connectors (supply chain).

This is why we are convening at the AI INFRA SUMMIT on May 1. We are moving past the hype to the "hard engineering" required to build the capacity for intelligence.

Upcoming Events

Bay Area Startups Collectively Secured $2.90B+ in January Week 4

This week's deals collected $2.90B for Silicon Valley startups, taking the January total to $29.95B and setting another record for January, more than $9B over the previous mark. This week there were ten megadeals – 80% of the total – with Genspark AI's $300M Series B at the top of the list. Seven of the ten megadeals were pureplay (AI infrastructure) or applied AI.

Exits: Check out January Week 4 Acquisitions. Seven SV companies acquired other companies, four SV companies were acquired. Sources gave Apple's acquisition of Q.ai a $2B pricetag. On the IPO front, Ethos Technologies completed theirs, raising $200M at a fully diluted valuation of $1.3B. It was a “down” IPO, their previous high valuation was $2.7B in their 2022 Series D-1 funding.

Webinar Alert: The February edition of our LinkSV-WITI Tech, Talent & Investment Trends webinar is next Friday, February 6. AI still rules, while valuations for frontier model startups are in the stratosphere - and one of them is talking up a 2026 trillion dollar IPO. We'll look at 2026 exits, liquidity and fundraising and how AI and non-AI startups are likely to be affected. Plus, a look at the AI bubbles - yes, there are multiple - and when they may burst - deflate - come down to earth. Join us at noon PT on February 6 to get the full picture. You can register here.

Follow us on LinkedIn to stay on top of SV funding intelligence and key players in the startup ecosystem.

Early Stage:

Ricursive Intelligence closed a $300M Series A, a frontier AI lab building the compute foundation for the next generation of AI.

Flapping Airplanes closed a $180M Seed, a foundational AI research lab solving the data efficiency problem.

Grid Aero closed a $20M Series A, building the future of autonomous cargo logistics.

Emobi closed a $3.4M Seed, enables seamless and secure EV charging across networks.

Growth Stage:

Genspark AI closed a $300M Series B, building agentic AI for more than one billion global knowledge workers.

Decagon closed a $250M Series C, conversational AI platform empowering every brand to deliver an AI concierge for every customer.

Span.io closed a $188M Series C, enabling electrification for all.

Prime Intellect closed a $49.9M Series B, makes frontier AI training accessible to every company.

AI factories run on GPUs. GPUs run on data. WEKA sits in the middle of that equation.

WEKA builds high performance data infrastructure designed to keep GPUs fed, saturated, and productive. As model sizes grow and clusters scale into the thousands of accelerators, storage performance becomes a gating factor for training speed, inference cost, and cluster ROI.

The WEKA Data Platform is built for AI workloads from day one. It delivers low latency, high throughput, and scalable performance across on-prem, cloud, and hybrid environments. Teams use WEKA to remove storage bottlenecks, reduce idle GPU time, and accelerate data pipelines across training and inference.

WEKA is deployed by leading AI labs, enterprises, and research institutions, and works closely with NVIDIA to support next-generation GPU architectures and large scale AI clusters.

Why It Matters

Most AI infrastructure discussions focus on chips and power. Storage and data movement quietly decide whether clusters run at 90 percent utilization or 30 percent. WEKA targets that invisible bottleneck and turns storage into a performance lever rather than a constraint.

Learn more at weka.io.

Your Feedback Matters!

Your feedback is crucial in helping us refine our content and maintain the newsletter's value for you and your fellow readers. We welcome your suggestions on how we can improve our offering. [email protected]

Logan Lemery

Head of Content // Team Ignite

What Will Your Retirement Look Like?

Planning for retirement raises many questions. Have you considered how much it will cost, and how you’ll generate the income you’ll need to pay for it? For many, these questions can feel overwhelming, but answering them is a crucial step forward for a comfortable future.

Start by understanding your goals, estimating your expenses and identifying potential income streams. The Definitive Guide to Retirement Income can help you navigate these essential questions. If you have $1,000,000 or more saved for retirement, download your free guide today to learn how to build a clear and effective retirement income plan. Discover ways to align your portfolio with your long-term goals, so you can reach the future you deserve.