- Valley Recap

- Posts

- 🤖 AI Workloads are Being Rewritten 💰Bay Area Startups Collectively Secured $2.64B 🏝️ PTC'26 Recap

🤖 AI Workloads are Being Rewritten 💰Bay Area Startups Collectively Secured $2.64B 🏝️ PTC'26 Recap

AI Workloads Are Rewriting Hyperscale Strategy

Three Critical Shifts Defining AI Infrastructure in 2026

The first Monday of 2026 made something clear: several major deals landed, and industry conversations pointed to an AI and data center boom that is accelerating. As 2026 shapes up to be a year defined by capacity constraints, three shifts are reshaping how AI infrastructure is built and delivered. Companies that recognize and adapt to these trends will be positioned to thrive.

The Rise of Inference Data Centers

The training era established a clear playbook: massive clusters in large facilities with abundant power and straightforward connectivity. Location didn’t matter much. What mattered was scale and uptime. If a power outage interrupted weeks or months of model training, you’d start from scratch.

Inference changes the equation. The currency is no longer just power capacity; it’s location, connectivity, and low latency. Inference workloads need to be near customers, near major metros, near the users actually running these AI applications. Clusters can be smaller. Uptime requirements are less critical than network performance.

This shift means we’ll see a proliferation of smaller, strategically located data centers serving inference workloads. The real estate strategy shifts. Infrastructure requirements follow, and the competitive advantage moves to those who can deliver capacity in the right locations with the right connectivity profiles.

Behind-the-Meter Power Goes Mainstream

Last year, behind-the-meter power generation was a stumbling block for many customers. Questions, hesitation, and uncertainty dominated the conversation. This year, that resistance is evaporating.

The outcome is straightforward: behind-the-meter solutions deliver capacity faster. For natural gas infrastructure in the United States specifically, reliability rivals or exceeds grid power. As the grid does its best to handle unprecedented AI power demands, customers are recognizing that behind-the-meter isn’t a compromise; it’s often the superior path to market.

We’re starting to see deals where behind-the-meter generation doesn’t even raise an eyebrow. The technology has proven itself, the infrastructure is reliable, and, most critically, it solves the timing problem that’s killing so many 2026 deployment plans.

The Evolved Broker Model

The traditional broker model of making introductions, passing requirements back and forth, and letting the operator handle fit-out and delivery is dead in 2026.

Brokers must get into the weeds with operators to help guarantee ready-for-service dates. This means understanding the entire supply chain: switchgear, generators, busways, PDUs, cooling infrastructure, rack and stack logistics. Any missing component can slip an RFS date, and in today’s market, those delays are expensive.

Even when acting primarily as a connector, brokers need relationships with equipment suppliers. They need to understand lead times, maintain backup options, and be prepared to help source whatever’s required to ensure delivery. The broker who can only make introductions will lose to the broker who can help guarantee outcomes.

At Infracore, we’ve been preparing for these shifts since last year. We’ve built short-RFS solutions for AI inference deployments, embraced behind-the-meter power generation, and developed an extensive partner network that can supplement any aspect of data center development to ensure RFS commitments are met.

The capacity crisis of 2026 will separate those who adapt from those who don’t. Understanding these three shifts isn’t optional; it’s foundational to closing business this year.

PTC 2026 // Honolulu, HI

Three Key Takeaways from PTC 2026:

Why This Conference Has Become Essential for Data Center Professionals: I just returned from my first Pacific Telecommunications Conference (PTC) in Honolulu, and I have to say this event has earned its reputation as one of the premier gatherings for the data center industry. While the name might suggest a focus purely on telecommunications, PTC has evolved into the go-to conference for everything data center-related, driven largely by the AI boom and explosive growth in our sector. This evolution makes complete sense when you understand the history.

Data centers emerged in locations where telecommunications infrastructure was first established, primarily in major financial centers. Cities like Chicago, New York, Tokyo, Hong Kong, London, and Northern Virginia became tier one data center markets because they already had the telecom interchanges necessary for financial transactions and global connectivity. A conference designed to bridge Asia-Pacific with the Americas, held at the beginning of each year in Honolulu, naturally became a critical meeting point for the global data center community.

Here are my three major takeaways:

The Location is Unbeatable Honolulu in mid-January offers perfect weather (t-shirt, shorts, and flip-flops throughout). The resort setting provided countless open-air venues for meetings and casual networking. Unlike many conferences where you're scrambling for meeting space or fighting over table reservations, PTC offered abundant places to connect with people organically. I noticed some companies reserved hotel suites or bar tables for the duration of the conference. While this provides a dedicated meeting space, it can also create isolation. Some of the best networking happened through spontaneous encounters when I was walking around, running into familiar faces, and meeting new contacts naturally. That organic networking is harder to replicate when you're stationed in a hotel room waiting for people to navigate elevators and find you.

Everyone You Need to Meet is There The breadth of attendees at PTC is remarkable. I connected with investors, developers, power equipment providers (critical given current supply chain challenges), cooling innovators, construction professionals, and off-takers ranging from kilowatt to gigawatt scale operations. I discovered a niche data center provider in New York City I hadn't known about and met an up-and-coming cooling company doing innovative work in liquid cooling. The conference serves as a genuine one-stop shop for the entire data center ecosystem with site selectors, hardware providers, operators, and everything in between. What I particularly valued were the deepening relationships with contacts I've been building over the past couple years. Seeing people for the third or fourth time in person, or finally meeting face-to-face after a year of phone conversations, creates momentum. These established relationships led to valuable introductions at parties and happy hours, the kind of organic business development that only happens when everyone's in the same place.

The Timing is Perfect Holding this conference in mid-January provides the ideal kickoff for the year. It sets the tone and gets deals moving early. For next year, I'm planning to extend my trip in both directions. I'll arrive a couple days early to schedule strategic meetings with more time allocated, avoiding the back-to-back rush that inevitably leads to domino-effect delays. I'm also planning to bring my family and stay several days after the conference to enjoy Honolulu together. PTC has definitely become an annual commitment for me. If you're serious about the data center industry, I highly recommend adding it to your calendar.

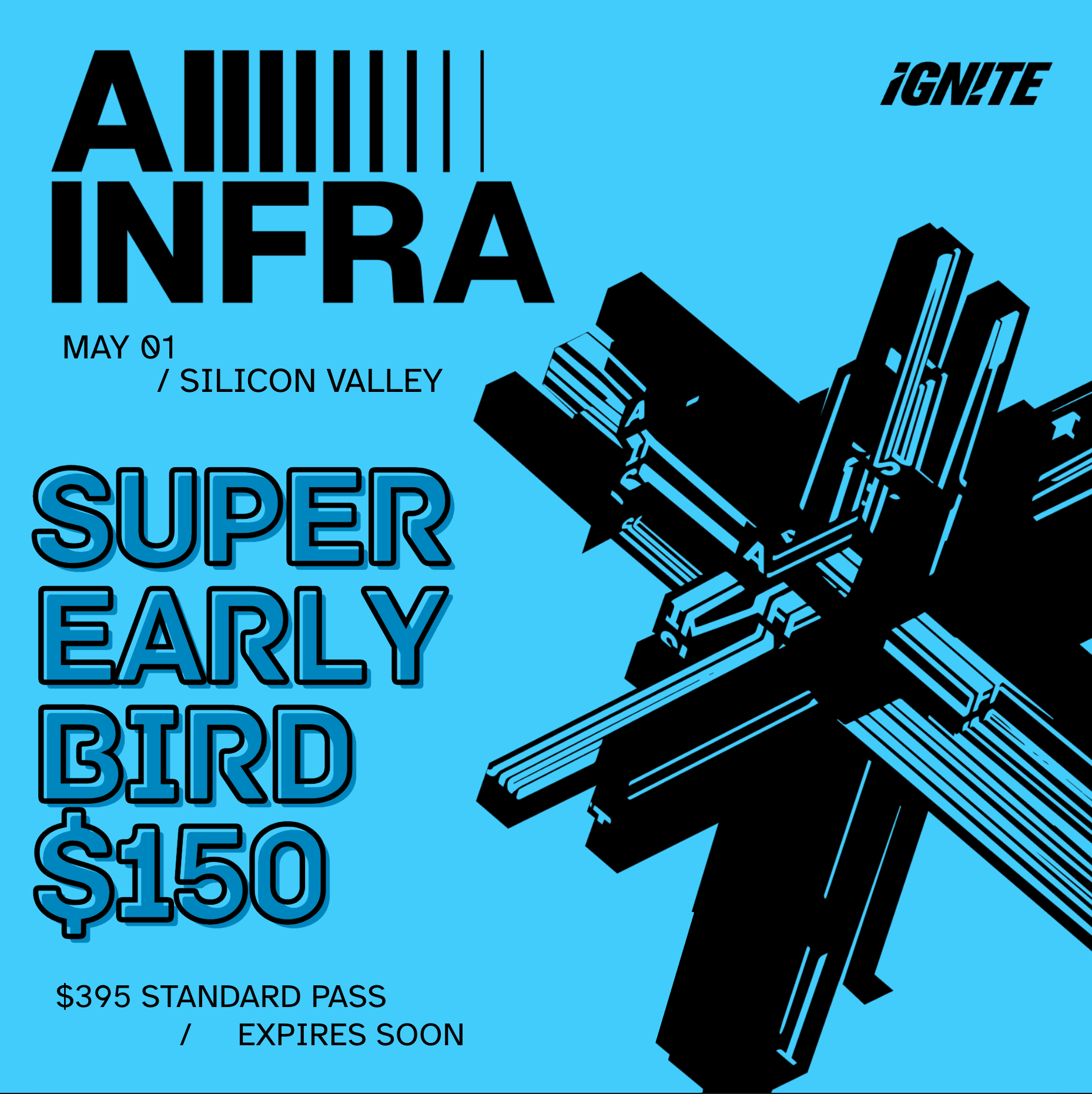

Upcoming Events

Bay Area Startups Collectively Secured $2.34B+ in January Week

This week's deals collected $2.34B for Silicon Valley startups, taking the January total to $27.05B and setting another record for the month of January, more than $7B over the previous record. There were seven megadeals – 82% of the total – across all funding stages, with a late stage $600M Series G for Zipline and at the other end, an early stage $480M seed round for Humans&. Six of the seven megadeals were pureplay (AI infrastructure) or applied AI.

Exits: The eight acquisitions today brought the week's total to thirteen. Ten SV companies acquired out-of-the-area companies for undisclosed amounts, while three SV companies were acquired, two for disclosed prices: GSK acquired Rapt Therapeutics (Nasdaq:RAPT) for $2.2B and Capital One acquired Brex for $5.15B. The Brex acquisition is a great return for their early investors, but not so much for the 2022 Series D-2 investors, when the company was valued at $12.3B.

For startups raising capital: Stay on top of who's raising, who's closing and who's investing with the Pulse of the Valley weekday newsletter. Click through to get more detail on investors and executives, including email addresses for both. Founders get the newsletter, database and alerts for just $7/month ($50 value). Check it out and sign up here.

Follow us on LinkedIn to stay on top of SV funding intelligence and key players in the startup ecosystem.

Early Stage:

Upscale AI closed a $200M Series A, a high-performance AI networking company.

Inferact closed a $150M Seed, an open source solution for lowering the cost of inference.

Haiqu closed a $11M Seed, a quantum software company developing a new application execution stack for all modalities of near-term quantum computers.

AiStrike closed a $7M Seed, the intelligence fabric that unifies detection, investigation, and response into a continuously self-improving SOC.

Blockit closed a $5M Seed, the AI scheduler for people who are back-to-back.

Growth Stage:

Zipline closed a $600M Series G, the world's largest and most experienced autonomous delivery service.

BaseTen closed a $300M Series D, providing the industry’s most advanced inference stack.

Railway closed a $100M Series B, a cloud platform that empowers developers to ship faster and more efficiently.

LiveKit closed a $100M Series C, helps you build realtime AI, and instantly transport audio and video between LLMs and your users.

We first covered Articul8 in this newsletter back in 2024, nearly two years to the day, when the company spun out of Intel to focus on enterprise generative AI.

Valley Recap - Jan 6th 2024 edition

That story has progressed.

Articul8 is currently raising a $70M Series B and has already secured more than half of the round at a reported $500M valuation. The raise comes as enterprises move from pilots to production deployments of generative AI, particularly in regulated environments.

What Stands Out

Articul8 has stayed focused on building generative AI systems that run within customer-controlled environments, with an emphasis on data governance, traceability, and operational control. That positioning has translated into growing enterprise adoption and larger contract sizes since the spin-off.

Why This Matters Now

Enterprise AI buyers are becoming more selective. Platforms built for internal deployment and oversight are seeing increased demand as organizations formalize AI usage beyond experimentation.

This round marks a clear step forward from the company’s initial spin-out phase into a scale phase.

Learn more at Articul8.

Your Feedback Matters!

Your feedback is crucial in helping us refine our content and maintain the newsletter's value for you and your fellow readers. We welcome your suggestions on how we can improve our offering. [email protected]

Logan Lemery

Head of Content // Team Ignite

Introducing the first AI-native CRM

Connect your email, and you’ll instantly get a CRM with enriched customer insights and a platform that grows with your business.

With AI at the core, Attio lets you:

Prospect and route leads with research agents

Get real-time insights during customer calls

Build powerful automations for your complex workflows

Join industry leaders like Granola, Taskrabbit, Flatfile and more.